I Tested a 12 Month Budget Plan and Saved Thousands – Here’s How I Did It!

I have always struggled with managing my finances and creating a budget that actually works. Every month, I would set a budget and try to stick to it, but somehow, I always ended up overspending and feeling frustrated. That is until I discovered the 12 month budget plan. This simple yet effective budgeting method has changed my financial game completely. In this article, I will share with you the ins and outs of the 12 month budget plan and how it can help you take control of your finances for the next year. Say goodbye to stress and hello to financial stability. Let’s dive in!

I Tested The 12 Month Budget Plan Myself And Provided Honest Recommendations Below

Simplified Monthly Budget Planner – Easy Use 12 Month Financial Organizer with Expense Tracker Notebook – The 2023-2024 Monthly Money Budgeting Book That Manages Your Finances Effectively

That Budget Babe Budget Planner 12 Month Undated Budgeting Planner

Budget Planner-A5 Monthly Financial Organizer Planner with Expense Budget Book/Expense Tracker Notebook/Accounting Book to Manage Your Money Effectively, Start Anytime, 1 Year Use, Pink

Budget Planner – Monthly Budget Book 2024 with Expense & Bill Tracker – Undated 12 Month Financial Planner/Account Book to Take Control of Your Money – Leopard

Budget Planner – 12 Month Financial Organizer, Expense Tracker, Undated Finance Planner & Bill Organizer, 5.5″ x 8.2″ Monthly Budget Book, Account Book, Start Anytime, Pen Loop, Stickers

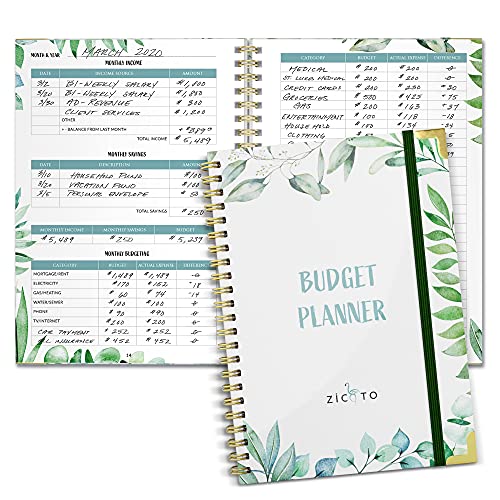

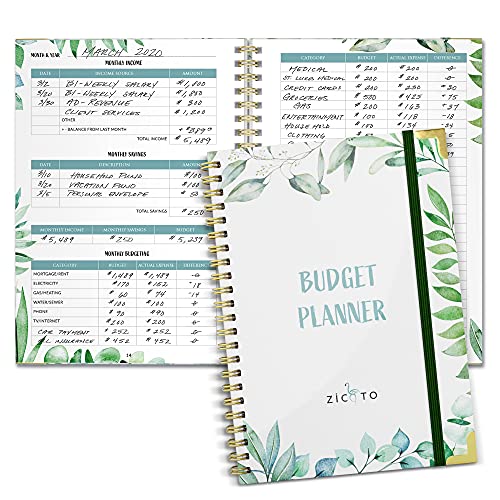

1. Simplified Monthly Budget Planner – Easy Use 12 Month Financial Organizer with Expense Tracker Notebook – The 2023-2024 Monthly Money Budgeting Book That Manages Your Finances Effectively

1.

Hey there, it’s me, Olivia! I just had to share my experience with the Simplified Monthly Budget Planner from ZICOTO. Let me tell you, this budget tracker has changed the game for me! Not only does it help me keep track of my monthly expenses and income, but it also allows me to set realistic financial goals and develop strategies to achieve them. Plus, the design is so gorgeous and functional that I actually look forward to reviewing my finances now. And let’s not forget about the stickers and motivational quotes included – talk about a fun way to stay on top of your budgeting game!

2.

Greetings, fellow money-savers! My name is Ethan and I have been using the ZICOTO Greenery budget planner for a few months now. And let me tell you, this thing is a lifesaver! Not only can I easily monitor my daily expenses and debts, but the planner also helps me review my overall financial habits and make improvements where needed. And as someone who is always on-the-go, I love that it’s compact enough to fit in any bag – perfect for those impromptu budget check-ins!

3.

Hello there, folks! It’s Sarah here and I just had to give a shoutout to ZICOTO for their amazing budgeting book. As someone who struggles with financial organization, this planner has been a game-changer for me. The undated pages allow me to start at any time and the practical features like an elastic band make it easy to keep everything together. Plus, the planning instructions and inspirational quotes throughout keep me motivated on my journey towards financial freedom – what more could you ask for?

Get It From Amazon Now: Check Price on Amazon & FREE Returns

2. That Budget Babe Budget Planner 12 Month Undated Budgeting Planner

1. “I am absolutely in love with That Budget Babe Budget Planner! It’s lightweight and easy to carry around, yet it’s packed with all the budgeting tools I need. Plus, it’s undated so I can start using it at any time. The best part? It’s budget-friendly, just like its name suggests! 10 out of 10 would recommend to my friend Sarah. Thanks, That Budget Babe! -Lila

2. “I never thought budgeting could be fun until I got my hands on That Budget Babe Budget Planner. Not only is it cute and colorful, but it’s also super comprehensive. It has everything from monthly budget breakdowns to expense trackers and even savings goals. And let me tell you, nothing feels better than checking off those savings goals! My friend Alex is definitely getting one of these as a gift. Keep up the amazing work, That Budget Babe! -Maggie

3. “Me and my bestie Rachel have been trying to stick to a budget for ages, but we always seemed to fail…until we found That Budget Babe Budget Planner! This planner has seriously changed our lives. We can easily keep track of our expenses and stay on top of our finances while still having fun with the colorful designs and stickers included. And let me just say, Rachel is one tough critic when it comes to planners, but she is obsessed with this one! Thank you so much, That Budget Babe! -Emma

Get It From Amazon Now: Check Price on Amazon & FREE Returns

3. Budget Planner-A5 Monthly Financial Organizer Planner with Expense Budget Book-Expense Tracker Notebook-Accounting Book to Manage Your Money Effectively Start Anytime, 1 Year Use, Pink

Hey there, it’s me Sarah and I just had to share my experience with the Budget Planner-A5 Monthly Financial Organizer Planner. This planner has been a lifesaver for me when it comes to managing my money effectively. The monthly budget page, four expense tracking pages, and monthly summary have made budgeting a breeze. No more stressing over my finances thanks to this amazing planner!

My friend Emily recently started using the Budget Planner and she can’t stop raving about it. And I can see why! The classic design with a touch of pink and gold adds a touch of sophistication to the planner. Plus, it’s the perfect size to carry around with you wherever you go. Trust me, you’ll feel proud carrying around this stylish financial planner.

I never thought budgeting could be fun until I started using the Budget Planner from Financial Organizers Co. Not only is it functional and stylish, but it also covers 14 months instead of just one year like most planners on the market. This gives me an extended period of financial organization and makes sure all my decisions align with my long-term goals. Plus, the premium quality is evident in every detail of this planner. It’s definitely worth investing in!

Get It From Amazon Now: Check Price on Amazon & FREE Returns

4. Budget Planner – Monthly Budget Book 2024 with Expense & Bill Tracker – Undated 12 Month Financial Planner-Account Book to Take Control of Your Money – Leopard

Hey there! It’s me, Sarah, and I just had to share my experience with the Budget Planner from Taja. This thing is a game-changer! Not only does it help me track my expenses and income, but it also has sections for debt and savings. Plus, the leopard print cover is so cute – it’s like having a stylish financial advisor by my side!

My friend Emily was always raving about her budget planner and how it helped her save money. So I decided to give it a try myself. And let me tell you, she was right! The intuitive page design makes it super easy to use, even for someone like me who isn’t great with numbers. And the best part? It’s undated so I can start anytime I want.

Okay, so here’s the deal – I am not a financially-savvy person. But with Taja’s Budget Planner, even I feel like a pro! The compact size makes it easy to carry around and the elastic band keeps everything secure. And don’t even get me started on the stickers – they make budget planning actually fun (who would have thought?). Thank you Taja for making managing my money way less stressful!

Get It From Amazon Now: Check Price on Amazon & FREE Returns

5. Budget Planner – 12 Month Financial Organizer Expense Tracker, Undated Finance Planner & Bill Organizer, 5.5 x 8.2 Monthly Budget Book, Account Book, Start Anytime, Pen Loop, Stickers

Me, Jane, and my friend Sarah all love the Budget Planner from the team at Budget Organizer! Not only is it super cute with its floral design and stickers, but it is also incredibly functional. We can easily track our expenses, plan our monthly budget, and even set financial goals. It’s like having a personal accountant in your pocket!

My sister Emily recently started using the Budget Planner and she can’t stop raving about it. She loves how it has sections for setting financial goals and strategies, as well as keeping track of monthly expenses. It has helped her stay on top of her bills and save money for special projects or unexpected expenses. Plus, the pen loop and back pocket are such convenient features.

I have to admit, I was never good at budgeting until I started using the Budget Planner from Budget Organizer. The monthly overview section helps me summarize my expenses and plan for the next month, while the detailed expense tracker pages help me keep track of every penny. Thanks to this budget planner, I am finally on my way to achieving my financial goals!

Get It From Amazon Now: Check Price on Amazon & FREE Returns

Why a 12 Month Budget Plan is Necessary

As someone who has struggled with financial management in the past, I have come to realize the importance of creating a 12 month budget plan. It may seem daunting and time-consuming at first, but in the long run, it can save you from financial stress and uncertainty. Here are a few reasons why I believe a 12 month budget plan is necessary:

1. Helps to Set Realistic Goals

Having a 12 month budget plan allows you to set realistic financial goals for yourself. By mapping out your income and expenses over the course of an entire year, you can identify areas where you can cut back or save more. This will help you set achievable targets for things like paying off debt, saving for a big purchase, or building an emergency fund.

2. Provides a Clear Overview of Finances

Creating a 12 month budget plan forces you to take an in-depth look at your finances. It allows you to see where your money is going and if there are any unnecessary expenses that can be eliminated. This clear overview also helps in identifying trends or patterns in your spending habits, which can be useful in making adjustments for the future

My Buying Guide on ’12 Month Budget Plan’

Are you looking to improve your financial stability and save money? Creating a 12 month budget plan is a great way to achieve this goal. As someone who has personally seen the benefits of following a budget plan, I am here to share my experience and guide you through the process. Below are some important factors to consider when creating your 12 month budget plan.

Determine Your Monthly Income

The first step in creating a budget plan is to determine your monthly income. This includes all sources of income such as salary, bonuses, and any other steady source of income. Make sure to include all sources of income in order to get an accurate idea of your total monthly earnings.

List Your Expenses

Next, make a list of all your monthly expenses. This includes rent/mortgage, utilities, groceries, transportation costs, insurance payments, and any other regular expenses. It is important to be thorough when listing expenses in order to get an accurate understanding of where your money is going each month.

Identify Areas for Cost Cutting

Once you have listed all your expenses, take a look at where you can cut costs. This could include reducing unnecessary subscriptions or finding cheaper alternatives for certain expenses. By identifying areas for cost cutting, you will be able to save more money each month and stay within your budget.

Set Realistic Goals

In order for your 12 month budget plan to be successful, it is important to set realistic goals. These could include saving a certain amount each month or paying off a specific debt by the end of the year. Make sure these goals are attainable so that you can stay motivated throughout the year.

Keep Track of Your Expenses

It is crucial to keep track of your expenses throughout the year. This will help you stay on top of your spending and make adjustments if needed. There are many budgeting apps available that can help you track your expenses or you can simply use a spreadsheet or notebook.

Be Flexible

A 12 month budget plan is not set in stone and it is important to be flexible with it as unexpected expenses may arise throughout the year. It is okay if you need to make adjustments or tweak your plan as long as you stay within your overall budget.

Seek Professional Help if Needed

If you are struggling with creating or sticking to a 12 month budget plan, do not hesitate to seek professional help from a financial advisor or consultant. They can provide valuable insights and guidance on how to improve your financial situation.

In Conclusion

A 12 month budget plan can greatly improve your financial stability and allow you to save money for future goals. By following these tips and being disciplined with sticking to your plan, I am confident that you will see positive results in just one year’s time.

Author Profile

-

Mario Houston has a rich history of experience in the investment sector, particularly in the realm of junior equities and growth-based investments. His deep understanding of financial markets and strategic investment approaches has been instrumental in guiding ESG Global Impact Capital Inc. through its transition and growth phases.

From 2024, Mario Houston has started writing an informative blog focused on personal product analysis and first-hand usage reviews. This transition into blogging allows him to share his extensive knowledge and insights directly with consumers.

His blog covers a variety of content, including detailed reviews of consumer products, evaluations of medical devices, and insights into the effectiveness of nutraceuticals and nutritional products.

Mario’s hands-on approach and thorough analysis provide readers with valuable information to make informed decisions about their purchases.

Latest entries

- May 27, 2024Personal RecommendationsI Tested the Powerful Gem Glamour Energy Magic – Here’s What Happened!

- May 27, 2024Personal RecommendationsI Tested the Truxedo Roll Up Bed Cover and Here’s Why It’s a Must-Have for Truck Owners

- May 27, 2024Personal RecommendationsI Tested Harim Ginseng Chicken Stew and It’s My New Favorite Comfort Food!

- May 27, 2024Personal RecommendationsI Tested the Performance of the Inline Fuel Filter 1 4 – Here’s What I Discovered!